CRYPCORE: A Stable, Private, Fast And Secure Digital Asset.

Crypto

currencies such as Bitcoin, Ethereum and Ripple have not only

established themselves as means of payment in recent years, but have

also increasingly proved to be a highly attractive field for

investments. However, the current situation on the cryptographic markets

is characterized by illiquidity, enormous volatility and a serious

asymmetry of information among the participants. But this makes the

market very lucrative and attracts speculators. Tenfold returns in less

than a year are not uncommon. But these gains are at the expense of the

ill-informed users. The success in crypto markets is based on

information advantages that few have over many.

This is the core problem: a lack of high quality, verifiable information. There is far too much noise in the relevant channels and far too little resilient facts. When you are in Telegram channels, slacks, subreddits and private forums you will find plenty of hype, insecurity and fears. This highly problematic dynamic opens crypto markets for fraudsters of all kinds. Small amounts of valuable information are often the key to unbelievable profits, so that for the ambitious trader or investor the comprehensive search for valuable information never ends. This makes it even more urgent to provide investors with comprehensive information that makes it easier for them to stay in the jungle of crypto currencies and to make buying and selling decisions based on valid data and trend analyses.

This is where the Crypocore application comes in. It provides a platform for intelligent data search and analysis for all crypto products. The time-consuming task of manually selecting and evaluating information is largely transformed into automated processes. With Crypocore, Stable coins were created to solve the problem of volatility as cryptocurrency adoption has been bottle-necked around price stability and also in the area of crypto collateralized coins.

This helps to create the possibility of creating a crypto collateralized stable coin that combines pure crypto exchanges, a solvency system and the Cryptonote protocol.

This is the core problem: a lack of high quality, verifiable information. There is far too much noise in the relevant channels and far too little resilient facts. When you are in Telegram channels, slacks, subreddits and private forums you will find plenty of hype, insecurity and fears. This highly problematic dynamic opens crypto markets for fraudsters of all kinds. Small amounts of valuable information are often the key to unbelievable profits, so that for the ambitious trader or investor the comprehensive search for valuable information never ends. This makes it even more urgent to provide investors with comprehensive information that makes it easier for them to stay in the jungle of crypto currencies and to make buying and selling decisions based on valid data and trend analyses.

This is where the Crypocore application comes in. It provides a platform for intelligent data search and analysis for all crypto products. The time-consuming task of manually selecting and evaluating information is largely transformed into automated processes. With Crypocore, Stable coins were created to solve the problem of volatility as cryptocurrency adoption has been bottle-necked around price stability and also in the area of crypto collateralized coins.

This helps to create the possibility of creating a crypto collateralized stable coin that combines pure crypto exchanges, a solvency system and the Cryptonote protocol.

CRYPCORE

Crypcore is creating a crypto asset that enforces a solvency system which eliminates wild price swings. Crypcore is essentially the combination of a crypto-collateralized digital asset with a solvency system to ensure price stability.

Crypcore is creating a crypto asset that enforces a solvency system which eliminates wild price swings. Crypcore is essentially the combination of a crypto-collateralized digital asset with a solvency system to ensure price stability.

PROBLEMS AND SOLUTION

Too much power on the part of the issuer

Stable coins can effectively be taken out of circulation at any time by the issuing organization. e.g the Omni Protocol of tether can grant and revoke tokens represented on the blockchain but with Crypcore this is not possible because of the technology that Crypcore is based on.

Too much power on the part of the issuer

Stable coins can effectively be taken out of circulation at any time by the issuing organization. e.g the Omni Protocol of tether can grant and revoke tokens represented on the blockchain but with Crypcore this is not possible because of the technology that Crypcore is based on.

Over issuance

The biggest problem with most stable coins is that they are issued the same way central banks issue money, this makes them vulnerable to over issuance and susceptible to inflation but the quantity of Crypocore in circulation is determined by the emission logic of the Cryptonote protocol and is visible to all.

The biggest problem with most stable coins is that they are issued the same way central banks issue money, this makes them vulnerable to over issuance and susceptible to inflation but the quantity of Crypocore in circulation is determined by the emission logic of the Cryptonote protocol and is visible to all.

Unstable Virtual Collateral

Virtual Collateral is itself unstable so using it to back a stable coin is difficult and confusing while crypcore uses its technology to solve this problem.

Virtual Collateral is itself unstable so using it to back a stable coin is difficult and confusing while crypcore uses its technology to solve this problem.

Highly Regulated

Fiat pegged stable coins are highly regulated and constrained by legacy banking systems.

Fiat pegged stable coins are highly regulated and constrained by legacy banking systems.

Expensive, slow liquidation & purchasing

Liquidating stable coins can be slow because with most stable coin providers you need to wire money to your account which will incur bank fees. Purchasing can also be slow as you sometimes need to undergo KYC procedures and transfer money which can sometimes take days.

Liquidating stable coins can be slow because with most stable coin providers you need to wire money to your account which will incur bank fees. Purchasing can also be slow as you sometimes need to undergo KYC procedures and transfer money which can sometimes take days.

Complex Smart Contracts

For crypto-collateralized digital assets like Maker Dai there is a problem of understanding. For regular everyday users the terms can seem unnecessarily complex. Crypcore will implement a very simple solvency equation system with easy to understand equation and parameters.

For crypto-collateralized digital assets like Maker Dai there is a problem of understanding. For regular everyday users the terms can seem unnecessarily complex. Crypcore will implement a very simple solvency equation system with easy to understand equation and parameters.

Poor Anonymity with stable coins

Stable coins do not offer any level of anonymity.

Stable coins do not offer any level of anonymity.

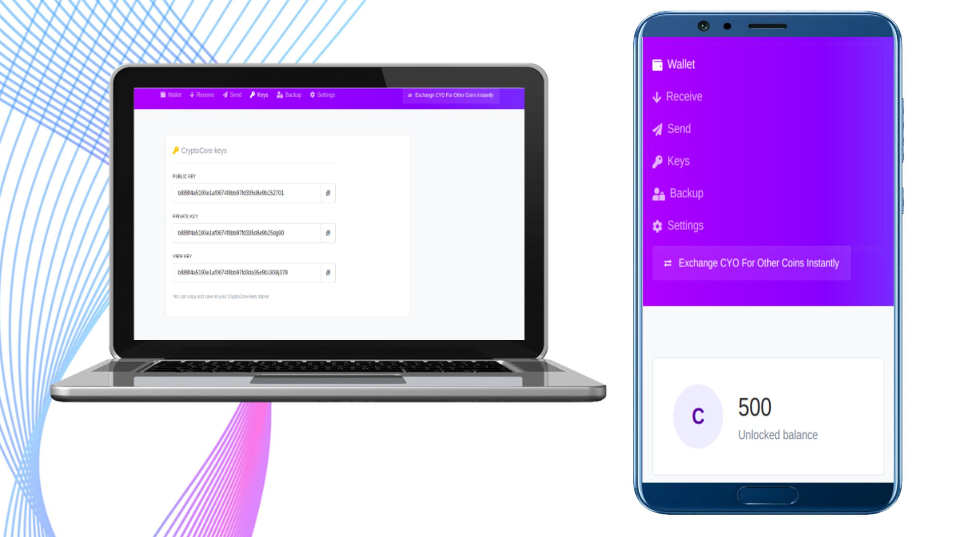

CRYPCORE WALLETS

Crypcore

means to be available to even non-specialized clients, wallets will be

accommodated a wide scope of stages. There will be work area wallets,

direction line wallets, equipment wallets and web wallets. After the

culmination of the Web Wallet improvement for android and iPhone wallets

will start. The web wallet is as of now being developed you can

discover screen shots underneath.

HOW CRYPCORE WORKS

Crypcore is forked from Monero which is based on the cryptographically secure and genuinely unknown Cryptonote convention, the Crypcoreecosystem unites a dissolvability condition, an unadulterated crypto trade and the Cryptonote convention to make a coin which has a steady cost with cost solidness accomplished by averaging the guarantee increment with value variances.

With this impact Crypcore is a steady coin which works in an on a very basic level distinctive approach to customary stable coins, we will consider it a Dynamic Stable Coin (DSC). Crypcore will acquire security from the expenses charged on the Crypcore trade, these expenses will be added to the insurance of the Crypcore coin hence continually expanding the guarantee and keeping up the soundness of the Crypcore Price. Crypcore isn’t to be seen as customary cryptographic money stable coin yet rather another and creative way to deal with accomplishing value strength in the digital currency space.

Crypcore is forked from Monero which is based on the cryptographically secure and genuinely unknown Cryptonote convention, the Crypcoreecosystem unites a dissolvability condition, an unadulterated crypto trade and the Cryptonote convention to make a coin which has a steady cost with cost solidness accomplished by averaging the guarantee increment with value variances.

With this impact Crypcore is a steady coin which works in an on a very basic level distinctive approach to customary stable coins, we will consider it a Dynamic Stable Coin (DSC). Crypcore will acquire security from the expenses charged on the Crypcore trade, these expenses will be added to the insurance of the Crypcore coin hence continually expanding the guarantee and keeping up the soundness of the Crypcore Price. Crypcore isn’t to be seen as customary cryptographic money stable coin yet rather another and creative way to deal with accomplishing value strength in the digital currency space.

Crypcore System

Well known stable coins are pegged against the US dollar and have a 1:1 proportion, Crypcore then again won’t be pegged at 1:1 yet will ascertain the cost from guarantee held. In that angle Crypcore can’t be viewed as a steady coin in the conventional feeling of the word. Crypcore will be comprised of various unmistakable parts working pair to keep up the cost of the Crypcore coin these will be: Crypcore Blockchain, Crypcore Mining, Crypcore Wallets and the Crypcore Instant exchange.

Well known stable coins are pegged against the US dollar and have a 1:1 proportion, Crypcore then again won’t be pegged at 1:1 yet will ascertain the cost from guarantee held. In that angle Crypcore can’t be viewed as a steady coin in the conventional feeling of the word. Crypcore will be comprised of various unmistakable parts working pair to keep up the cost of the Crypcore coin these will be: Crypcore Blockchain, Crypcore Mining, Crypcore Wallets and the Crypcore Instant exchange.

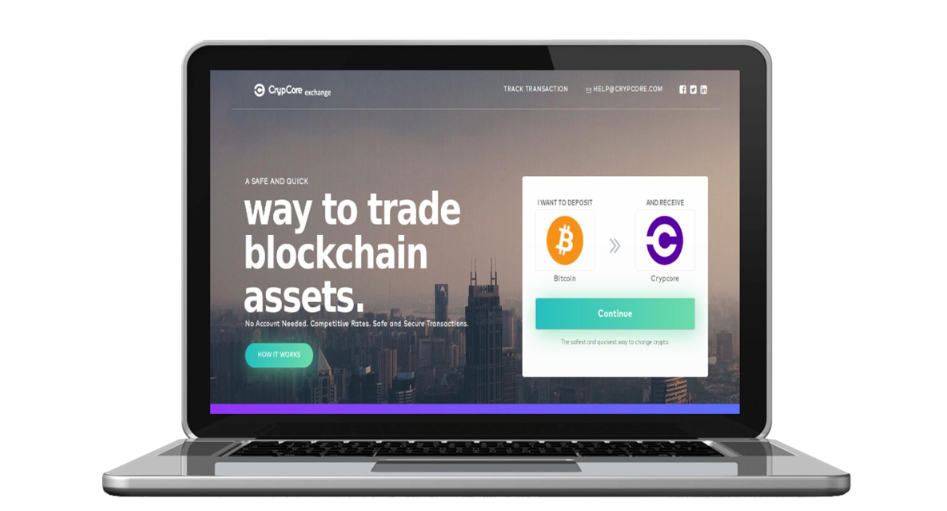

Crypcore Exchange

Crypcore

trade will assume a significant job in dealing with the cost of

Crypcore. To do this Crypcore Exchange should get things done in a

whimsical way. An extremely straightforward dissolvability condition

will decide the evaluating of Cryps. In typical stable coins the tokens

are given by the essential association however Crypcore trade won’t have

the option to make tokens, rather each coin is mined.

This is on the grounds that the protection and security of our clients are of most extreme significance. With the end goal for Cryps to hold their worth the underlying cash supply is mined and held by the Crypcore trade. The Cryps held by the trade won’t be viewed as being available for use. The Crypcore trade as of now is an unknown moment trade. These are screen captures of the trade.

This is on the grounds that the protection and security of our clients are of most extreme significance. With the end goal for Cryps to hold their worth the underlying cash supply is mined and held by the Crypcore trade. The Cryps held by the trade won’t be viewed as being available for use. The Crypcore trade as of now is an unknown moment trade. These are screen captures of the trade.

TOKEN DETAILS

Token name: crypocre(CYRP)

Accepted payment: BTC, ETH, LTC

Soft cap: 3million

Hard cap: 7million

1 crypcore: 0.00001 ETH

Min/Max Personal Cap: 0.01 ETH / No limit

Token name: crypocre(CYRP)

Accepted payment: BTC, ETH, LTC

Soft cap: 3million

Hard cap: 7million

1 crypcore: 0.00001 ETH

Min/Max Personal Cap: 0.01 ETH / No limit

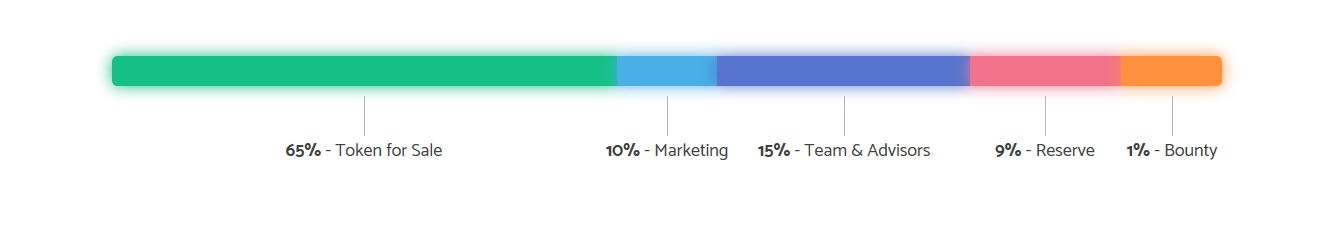

TOKEN DISTRIBUTION

65% — Token for Sale

10% — Marketing

15% — Team & Advisors

9% — Reserve

1% — Bounty

10% — Marketing

15% — Team & Advisors

9% — Reserve

1% — Bounty

ROADMAP

Q2 2019 — Idea Realisation & Research

$50,000 private funding

Q2 2019 — Idea Realisation & Research

$50,000 private funding

Q3 2019 — Architecture Design & Whitepaper publication

Q4 2019 — Launch Crypcore Instant Exchange

Launch block Explorer

Start trading crypcore on exchanges

Launch block Explorer

Start trading crypcore on exchanges

Q1 2020 — Launch Web Wallet

Q2 2020 — Launch Mobile Wallet

Q3 2020 — Launch New features for Crypcore Exchange

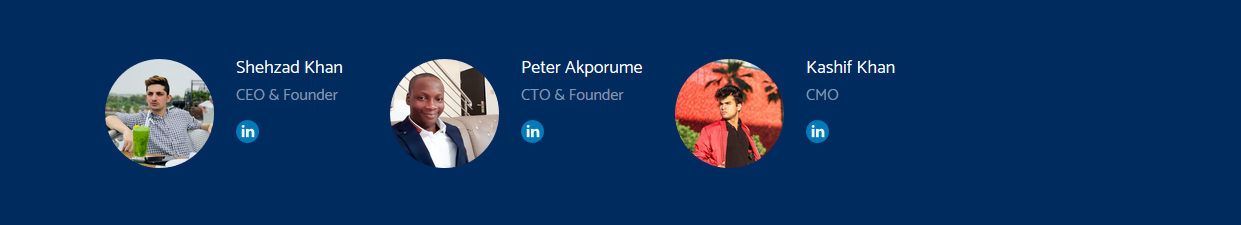

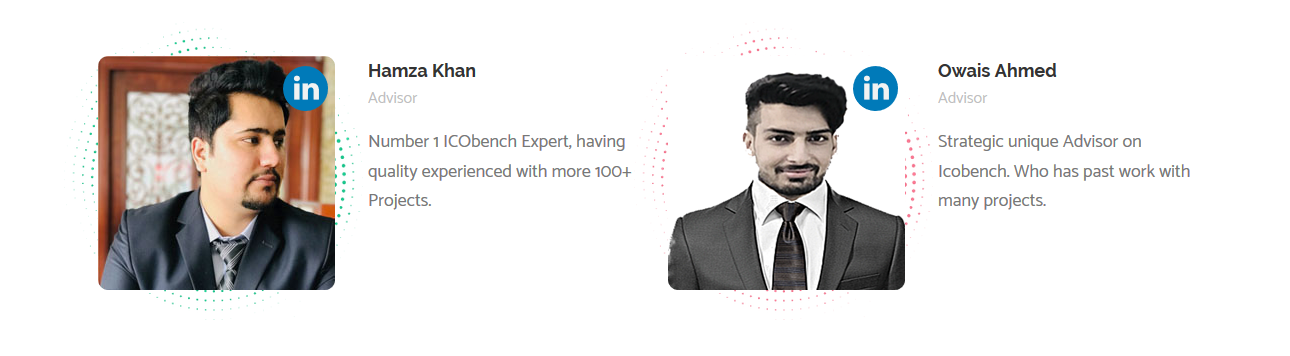

MEET THE GREAT MINDS BEHIND THIS WORK

For more Information, Please visit the following sites:

Website: https://crypcore.com/

Whitepaper: https://crypcore.com/crypcore_whitepaper_version_1.pdf

Telegram: https://t.me/crypcore_group

Facebook: https://www.facebook.com/Crypcore-106479097438958

Twitter: https://twitter.com/crypcore1

Reddit: https://www.reddit.com/user/crypcore

Website: https://crypcore.com/

Whitepaper: https://crypcore.com/crypcore_whitepaper_version_1.pdf

Telegram: https://t.me/crypcore_group

Facebook: https://www.facebook.com/Crypcore-106479097438958

Twitter: https://twitter.com/crypcore1

Reddit: https://www.reddit.com/user/crypcore

Author: Seunola

MyBitcoinTalk profile: https://bitcointalk.org/index.php?action=profile;u=1925064

ETH Address: 0x3eb48CF7E0A5570540641DD8263cA40e307562e9

MyBitcoinTalk profile: https://bitcointalk.org/index.php?action=profile;u=1925064

ETH Address: 0x3eb48CF7E0A5570540641DD8263cA40e307562e9

Comments

Post a Comment